- March 28, 2025

- 22min read

CFD vs ETF: What Are The Differences

Contracts for difference (CFDs) and exchange traded funds (ETFs) are popular financial instruments that help traders and investors gain exposure to the financial markets. In this article, we explore the main differences between these two investment products.

What’s The Main Difference Between Trading CFDs and ETFs?

The main difference between trading CFDs and ETFs lies in the level of exposure to the underlying asset. CFDs are derivative instruments that mirror the price of an underlying asset without providing ownership. On the other hand, ETFs function as funds that hold the assets they represent, offering more direct exposure.

When you trade CFDs, you speculate on price movements without owning the underlying asset. This method offers advantages such as leverage and is often used for short-term trading strategies. The trading methods and risk profiles to trade ETFs differ significantly from trading CFDs.

Exchange traded fund (ETFs) are popular investment vehicles that allow for diversified asset exposure. They are similar to mutual funds but with the added benefit of being traded on exchanges throughout the day. This makes ETF trading flexible for both short-term and long-term strategies.

It is possible to trade ETF CFDs, where you speculate on the price movements of ETFs without owning the underlying assets, similar to other CFDs.

In this article, we explore the key differences between these popular financial products to help you decide which one is right for you – or whether it makes sense to consider both, as they may complement each other.

Let’s continue by highlighting a few more operational differences worth considering:

Asset Ownership

CFDs don’t provide ownership of the underlying asset. For example, buying gold CFD or Nvidia CFD doesn’t mean you own the commodity or the stock. Instead, CFDs allow traders to speculate on price movements, acting as financial bets.

In contrast, an exchange traded fund (ETF), provides ownership of the underlying assets held in a fund’s reserves, be it stocks, commodities, bonds, or even cryptocurrency..Therefore, buying a gold ETF means acquiring a stake in the fund that actually holds gold.

Due to this major difference, buying CFDs is preferred among traders, while purchasing ETFs for long-term holding is preferred by investors or infrequent traders.

Market Access

CFDs are traded over-the-counter (OTC) and can be accessed via specialised brokerage firms that provide trading terminals and multiple tools for a better trading experience.

ETFs are traded on stock exchanges like the New York Stock Exchange (NYSE) and are available through stock brokers.

Depending upon the CFD broker’s setup, some CFD trades may be held internally by the broker, while other trades are passed along in straight-through processing. Elsewhere, stock brokers act as intermediaries between traders and the stock markets.

Asset Choice

CFDs offer access to hundreds of markets, allowing traders to speculate on a wide range of assets. Traders can speculate on commodities, foreign exchange (forex) currencies, cryptocurrencies, stocks, and indices.

Over recent decades, ETFs have gained in popularity with many ETFs created around a variety of assets. CFDs generally offer more choices in assets to trade though both products have plenty of options to choose from.

Financing

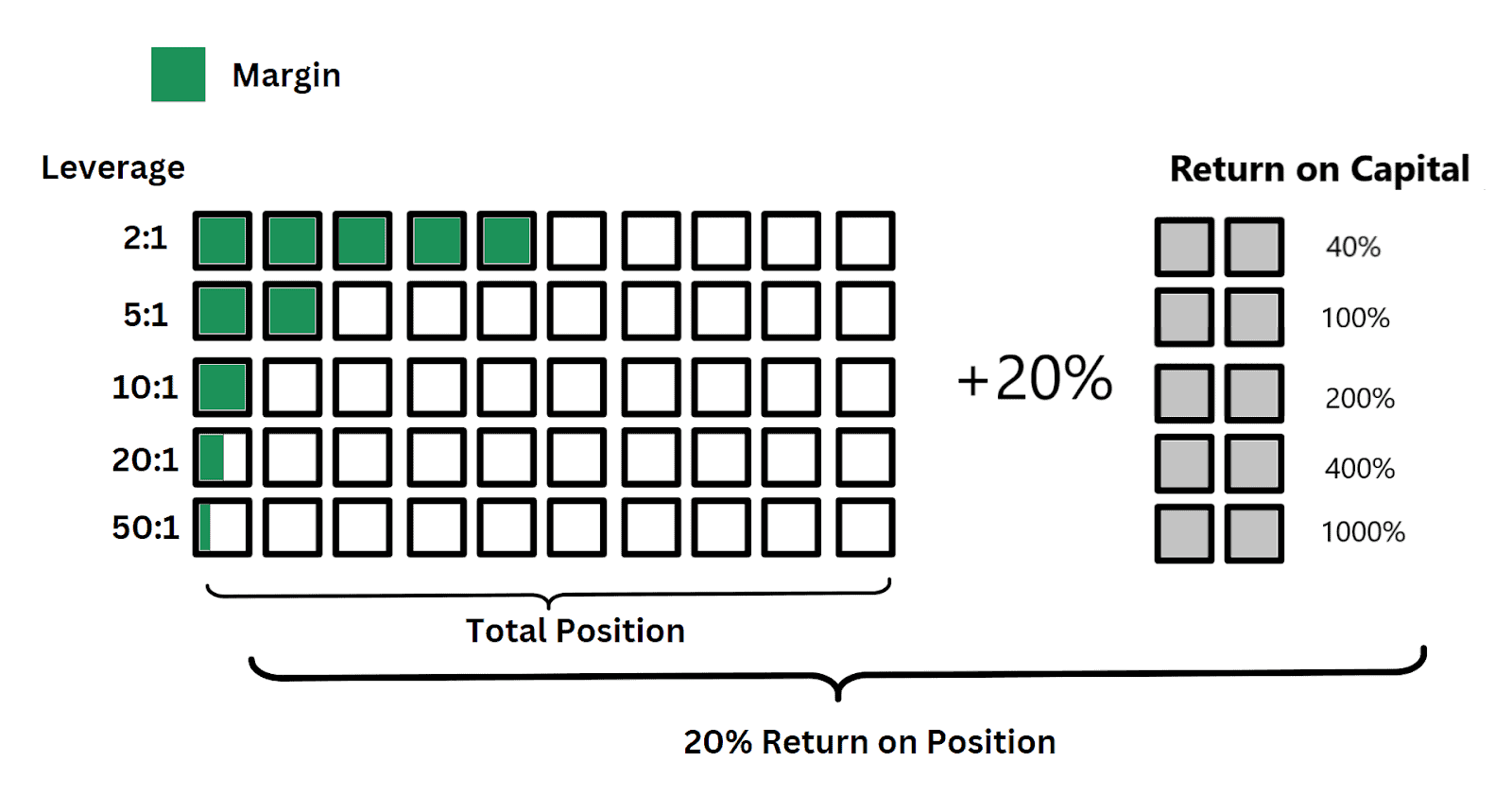

Most CFDs support margin trading, where traders use leverage to expand their market exposure via borrowed funds. For example, using 10:1 leverage would require traders to commit only 10% of their own funds as a good faith deposit, with the rest of the trade funded by the broker. This approach is used to make more efficient use of up front capital as the full trade size is not required to be deposited in the account. As a result, overnight financing charges may apply that eats into long-term returns.

Elsewhere, ETFs typically don’t use high leverage, making them a safer investment option for those looking for longer-term returns without the risk of margin calls. In the US, some brokers offer 2:1 leverage but require a minimum deposit of $2,000 and charge interest on the borrowed funds.

It is worth noting that there are some 2x and 3x ETFs that are riskier than their counterparts with no leverage. The sole purpose of these leveraged ETFs is to leverage the underlying asset by 2x or 3x. As a result of the leverage and regular adjustments, these ETF’s performance will slip over longer periods of time when compared to the underlying asset. This makes leveraged ETFs a riskier asset than the standard ETF.

Risk Profile

CFDs are considered to be riskier than ETFs, especially when leverage is used. With margin trading, losses can exceed the deposited capital, requiring CFD traders to implement risk management techniques to control losses. However, potential short-term gains can be higher with CFDs with the right strategy.

ETFs tend to be less volatile, although this mainly depends on the underlying assets. Index ETFs and sector-related ETFs offer diversified exposure, further reducing risks.

Cost

The upfront cost to invest in a CFD is minimal as commissions are small or even zero on some products. However, over the long run, CFDs can be more expensive as they often incur financing charges for holding positions overnight.

ETFs incur a commission that can add to costs quickly for active traders. However, they tend to have lower management fees making them cost-effective for long-term investors. For active trading, CFDs are more convenient.

Leverage

ETFs are generally unleveraged, though some 2x or 3x leveraged ETFs exist. The leveraged ETFs recalibrate each day so the price of the 2x ETF is rarely actually twice of the underlying.

CFDs, on the other hand, simply mimic the price of the underlying and use financing to fund the trade. As a result, the leverage available can be significantly higher than the 3x seen in some ETFs. Keep in mind, more leverage does not always equate to more profits because if the market moves against your trade, it can also mean more losses.

Regulation

CFDs and ETFs are treated differently by financial watchdogs in most jurisdictions. In the US, ETFs are considered securities and regulated by the Securities and Exchange Commission (SEC), while CFDs are illegal.

In the European Union, CFDs are allowed but under strict regulations.

What are CFDs?

CFDs (contracts for difference) are financial derivatives that give traders exposure to underlying assets without providing ownership. Thanks to CFDs, traders can speculate on the price of a wide range of assets through the same platform.

The goal of a CFD is to track the price of the underlying asset as closely as possible.

CFDs are typically suited to traders interested in taking short-term and medium-term exposure to preferred markets, aiming to profit from the market’s rise or decline.

CFD traders can multiply potential profits using leverage, which requires only partial funding from a trader’s own funds. However, that leverage works both ways and can also amplify losses making them riskier.

These products are part of a broader group of derivatives, which also include futures and options, with CFDs being more flexible and convenient.

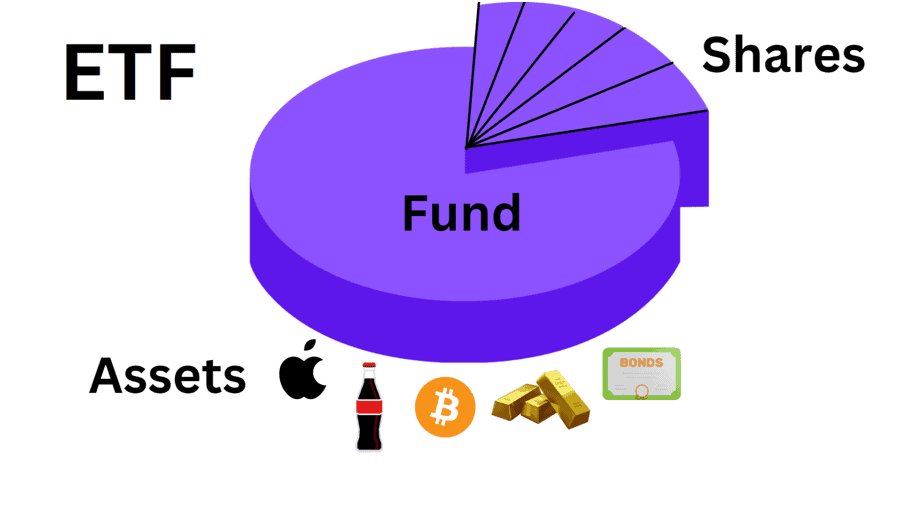

What are ETFs?

ETFs (short for exchange-traded funds) are funds that hold a mix of assets or individual assets that are not available for trade through traditional stock markets, such as commodities or cryptocurrency.

ETFs are traded via stock exchanges in the form of shares, similar to regular stocks.

Thanks to ETFs, investors can get diversified exposure to whole sectors or the entire stock market. For example, there are several ETFs representing the S&P 500 index, which tracks the top 500 public companies by market cap across several industries.

Buying ETFs means owning a share of the fund, benefiting from its value appreciations or dividend payments, when applicable.

How CFDs Work

A CFD is a contract between two parties: the trader and the broker. According to the contract, the broker pays the trader the difference between the open and close prices of the asset, provided the trader accurately predicts the price movement. If the trader’s prediction is wrong, he pays the difference to the broker from his balance, incurring a loss.

Traders can either buy or sell a CFD. When buying, traders aim to profit from the price appreciation of the underlying asset, closing the position above the entry price to secure the profit. When selling, traders seek to profit from the price decline of an asset, closing the position below the entry price to take the profit.

On a side note, buying a CFD, ETF or any other financial instrument to benefit from the price appreciation is also referred to as ‘going long’ or ‘opening a long position.’ In contrast, selling or betting on the price decline is also called ‘going short’ or ‘opening a short position.’

In the case of CFDs, the size of the profit or loss depends on the price performance while the position is open. For example, if the Apple CFD gains 10% during the time of the trade, this results in a 10% return on the position. With margin, traders can amplify returns by borrowing funds from the broker. For example, using 5:1 leverage and securing a 20% return on the position would turn the profit into a 100% return on the trader’s initial deposit.

However, losses are magnified in the same way, meaning a 20% market decline would result in a 100% loss of a trader’s deposit.

Trading CFDs

CFDs offer probably the most straightforward trading experience. These financial instruments mimic the price movements of underlying markets or stock index, helping traders speculate on the market’s ups and downs. Trading ETF CFDs involves similar strategies to other CFDs, but with a focus on the price movements of the ETFs.

Buying or selling a CFD works like trading the market it represents, but without actually owning the asset.

CFDs offer a way to trade global markets with leverage, amplifying potential profits.

Advantages of Trading CFDs

- Margin trading – with leverage, CFDs provide higher potential profits for a given price gain compared to ETFs. Alchemy Markets offers up to 20:1 leverage for stocks and indexes and up to 5:1 leverage for commodities.

- Convenience – CFDs are more convenient and easier to trade, having a direct relationship to the price movement of the underlying asset. Alchemy Markets offers educational guides, strategies, and tools to improve the CFD trading experience.

- Market choice – CFDs provide a wide choice of markets. Alchemy Markets supports stocks, indices, commodities, and foreign exchange (forex) currencies, which are not available with ETFs.

- Short-selling – with CFDs, short-selling is more straightforward, as traders have just to open short positions. With ETFs, short-selling involves borrowing the shares from the broker and selling them.

- Transparent Pricing – The CFD mimics the underlying asset and is often priced the same as the underlying asset. The cost to get into and out of the trade is very clear. Most CFDs have zero commissions. The cost to the trader is the difference between the bid and ask (buy and sell) price.

- No Expiries – There is no expiration date for the CFD. A trader can hold it as long as they want so far as they have enough unused margin to support holding the trade open.

Disadvantages of Trading CFDs

- Higher risks – leverage is a double-edged sword. While it can boost profits, the risk of losses increases by the same magnitude. Alchemy Markets enables risk management tools like stop losses to limit potential damage.

- No ownership – CFDs don’t provide ownership, meaning that you don’t own the asset when you buy a related CFD.

- Weaker regulation – the oversight of CFDs is weaker compared to most ETFs traded on the US stock markets, which are under the supervision of the SEC. For CFD traders, it’s imperative to deal with a reputable and regulated broker, such as Alchemy Markets.

How ETFs Work

ETFs are funds representing baskets of securities. The funds are built by a financial institution and are available in the form of shares.

Usually, ETFs track certain sectors, indexes, bonds, or assets that are difficult to access through stock exchanges, such as gold or Bitcoin.

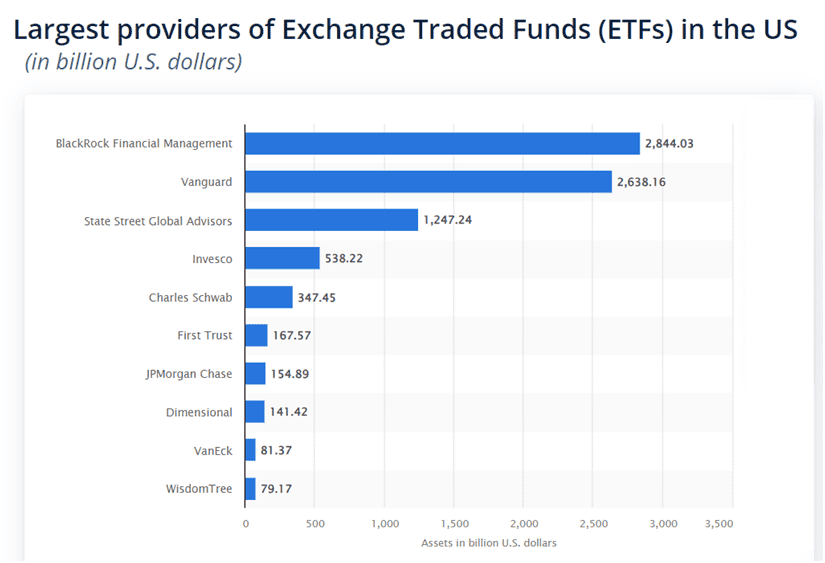

In 2024, the largest ETF issuers by total assets under management are Blackrock – whose total ETF value is nearly $2.9 trillion – Vanguard, with over $2.6 trillion in total assets, and State Street, with $1.2 trillion.

Source: Statistica

BlackRock offers 433 ETFs, followed by First Trust, with 252 funds, and Invesco, with 228.

The shares of these funds are traded on stock exchanges, such as the NYSE or Nasdaq.

Investors can buy shares in these ETFs through brokerage firms like TD Ameritrade, E*Trade, or Robinhood.

Many ETFs invested in stocks or bonds pay dividends. For example, BlackRock’s top 10 ETFs by total asset value pay dividends with annual yields ranging from 0.55% to 3.6%.

ETFs require a management fee, paid annually and automatically deducted from the fund’s returns. The management cost typically ranges between 0.15% and 0.3% per year. Brokers may charge additional fees for facilitating the trade.

How ETFs are Priced

The price of the ETFs are based on their Net Asset Value (NAV). The Net Asset Value (NAV) is the total value of an ETF’s underlying assets (stocks, bonds or other securities) minus its liabilities divided by the number of outstanding shares.

NAV is calculated at the end of each trading day. While ETFs trade on exchanges like stocks, their market price often tracks the NAV because of arbitrage. Traders do this by buying or selling ETF shares and the underlying assets when there is a mismatch and keep the price close to the NAV.

How NAV Differs from CFD Pricing

Contracts for Difference (CFDs) don’t involve ownership of the underlying asset. They track the asset’s price movement. CFD pricing is based on the underlying market, broker’s spread, and sometimes external factors like interest rates or overnight fees. CFDs don’t have an NAV as there are no physical holdings to value. ETF pricing is anchored to its NAV, which is why it’s transparent and stable. CFDs, being derivatives, lack transparency and stability.

Types of ETFs

There are multiple types of ETFs that suit different investment objectives and risk profiles. Here are the main categories:

- Equity ETFs – these ETFs mimic stock index funds like the S&P 500 or NASDAQ, offering exposure to a broad range of companies or specific industries.

- Bond ETFs – these ETFs track various bond indices, focusing on government, corporate, or a combination of both types of bonds.

- Commodity ETFs – they track the price of commodities like gold, oil, or agricultural products, providing exposure to physical assets without having to hold them.

- Sector ETFs – these are a type of equity ETFs that target certain industries or sectors, such as technology, healthcare, or artificial intelligence (AI).

- International ETFs – these ETFs give access to non-US markets and economies, focusing on companies and assets from specific countries or regions.

- Currency ETFs – these ETFs track the performance of foreign currencies in relation to the USD or other currencies, being used for currency speculation. However, these are very few currency ETFs, and they are not very popular among investors.

- Cryptocurrency ETFs – in 2024, the SEC has approved applications for Bitcoin and Ethereum ETFs marking the first time investors can trade crypto ETFs.

- Passive/active ETFs – passive ETFs are designed to track an index or a market by mirroring its performance. Active ETFs hold stocks and assets selected by analysts to beat the broader market. The latter have higher fees.

- Inverse and Leveraged ETFs – inverse ETFs seek to profit from the decline of a market, being used by short traders. Leveraged ETFs use certain derivatives (other than CFDs) to amplify the returns of an underlying index or sector.

Advantages of Trading ETF

- Ownership – buying ETF shares means owning a fraction of the fund. The shares can be held for months or years without incurring overnight fees.

- Diversification – most ETFs provide built-in diversification by holding a basket of assets, especially if they are tracking an index fund like the S&P 500 Index.

- Long–term goals – ETFs are more suited for long-term investment strategies, where the goal is to benefit from gradual growth.

- Regulated environment – in many jurisdictions, ETFs are traded in a highly regulated environment, providing investors with added security. For example, traditional USA investors can gain exposure to Bitcoin through Bitcoin ETFs, which are regulated by the SEC.

- Dividends – many ETFs pay dividends from underlying stocks and bonds.

Disadvantages of Trading ETFs

- No Leverage – Most ETFs do not typically offer leverage, meaning that returns are directly tied to the amount invested. This can be a drawback for active traders seeking amplified returns, which are common in CFD trading.

- Limited Market Choice – ETFs are generally focused on market indices, stocks, bonds, and several commodities. In contrast, CFDs offer a broader range of markets, including forex pairs, commodities, indices, individual stocks, and more cryptocurrencies besides Bitcoin and Ethereum.

- Complex Short-selling – while you can short-sell certain markets by buying an inverse ETF, oftentimes, the returns are not fully correlated due to the derivatives involved.

CFD vs ETF Example

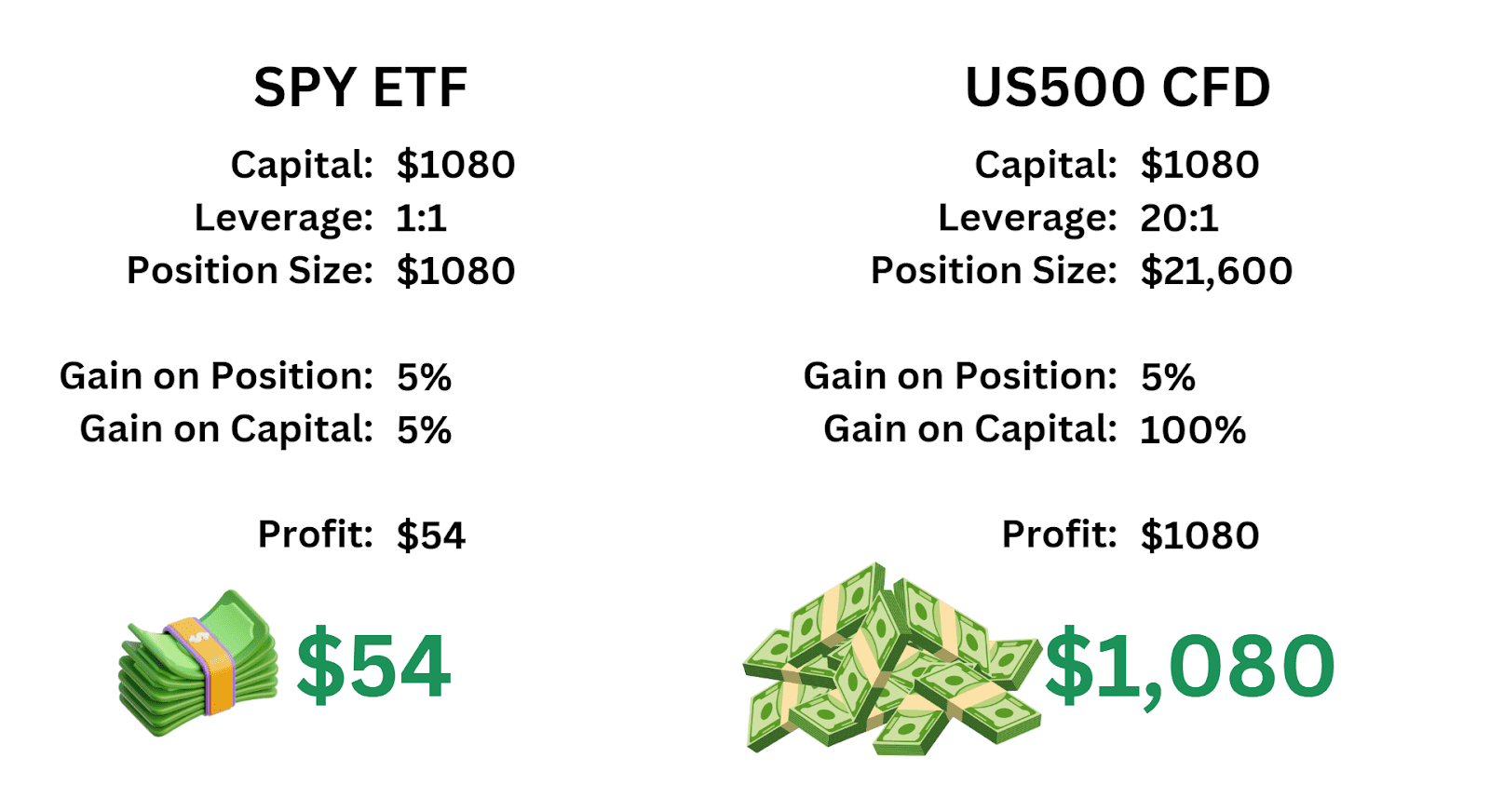

Let’s explore how trading CFDs differs from buying ETFs. For this example, we’ll use the S&P 500 index as the underlying asset.

- ETF example – to gain exposure to the S&P 500 index, you can buy one share of the SPDR S&P 500 ETF Trust (SPY), issued by State Street. Let’s say that you buy two shares at a price of $540 per share, investing $1,080.

Buying the two shares means owning a small fraction of the fund.

In our example, the S&P 500 index increases by 5% within a week. Since the ETF mirrors the performance of the index, it would also rise by 5%, generating a return of 5% or $54 on the initial investment. - CFD example – if you trade a CFD representing the S&P index, you can speculate on its performance without owning any portion of a fund. Let’s say that you invest $1,080 in the US500 CFD offered by Alchemy Markets, using 20:1 leverage. Thanks to the leverage of this hypothetical winning position, the total value of your position is $21,600, with 5% of your own contribution to cover the margin requirement.

If the S&P 500 index rises by 5% within a week, your position would return $1,080, which is a net return of 100% on your initial investment, which is much higher than the ETF’s return of only $54.

However, if the CFD declines by 5%, you risk losing your entire deposit, which is not true for ETFs.

This example shows that CFDs offer higher short-term gains with greater risk, while ETFs provide a safer, long-term approach.

Choosing the Right Trading Strategy

CFDs and ETFs work best under certain circumstances. Traders should consider the following aspects:

Your Trading Style and Goals

The choice between CFDs and ETFs should align with your style and goals. If you prefer short-term trading, CFDs might be better due to their flexibility and higher leverage. CFD swap rates and finance charges can eat into long-term held positions. However, if you in and out of trades without holding them for long periods of time, the finance charges will be significantly less or possibly zero.

Elsewhere, ETFs work best for passive, long-term investors.

Market Conditions and Trading Opportunities

Market conditions play an essential role in selecting the right trading strategy. Short-term trading CFDs can be applied in range-bound, trending, and volatile market conditions, allowing traders to profit from price movements in either direction.

ETFs, on the other hand, are generally viewed as longer-term holdings geared towards growth in the price of the asset or by earning a regular dividend.

Active Trading vs Passive Investment

Active traders would prefer CFDs due to their flexibility, high leverage, and the possibility to capitalise on short-term price fluctuations.

Passive investors would opt for ETFs for their simplicity and built-in diversification. They can build a long-term portfolio of equities and ETFs requiring minimal involvement.

Day Trading

Day traders open and close positions within the same day. CFDs are typically preferred for day trading because of their high leverage, ability to trade on short-term price movements, and straightforward short selling. Most CFDs (non-stock CFDs like forex CFDs) typically have no commissions and are especially preferred by scalpers, which operate with trades that last seconds or minutes.

Swing trading

Swing traders hold positions for several days or weeks. Both CFDs and ETFs are suitable for swing trading, but CFDs offer greater flexibility and leverage, although exposing traders to more risk.

Position trading

Position trading involves holding investments for weeks, months, or even years. ETFs are typically more suited for this strategy due to their long-term stability and lack of swap rates. CFDs, while flexible, are less ideal for longer periods due to potential fees.

Possibility of Ownership

With ETFs, traders own a stake in a fund, which provides indirect ownership of the underlying assets meaning you reap the benefits of corporate actions like dividends.

In contrast, CFDs do not provide ownership. When you trade CFDs, you speculate on price movements. This approach may be more suitable for short-term traders.

Product Pricing

CFDs typically incur additional costs in the form of spreads, swap rates, and overnight fees. ETFs come with lower costs, as they often only charge an annual management fee and have tight spreads. However, you will pay a commission to trade an ETF so active trading can eat away at your returns.

CFD vs ETF: Key similarities

While CFDs and ETFs are completely different financial products, they share similarities. Here are some of them:

Flexible Underlying Assets

Both CFDs and ETFs offer exposure to a diverse number of markets, including stocks, indices, commodities, currencies, and cryptocurrencies. Still, ETFs tend to focus on a basket of equities, while CFDs offer a broader selection of specific assets including forex pairs.

Dividends

ETFs holding company shares can pay dividends in cash, or less commonly, in the form of additional shares. These dividends are distributed based on the dividends paid by the companies held within the ETF’s portfolio and are often paid quarterly, though frequency can vary. You may receive a dividend adjustment in a CFD for long positions (or pay an adjustment for CFD short positions) to account for the dividend. This adjustment is credited or debited to your account to mimic the economic impact of holding the actual stock or ETF.

Hedging

Both CFDs and ETFs can be used to hedge other positions in a portfolio. For instance, traders may use inverse ETFs to hedge their exposure to stocks or certain market sectors.

CFDs provide better hedging capabilities due to their flexibility. For example, a trader long Apple stock can easily short Apple CFD to hedge. Hedging is more difficult and not as direct with an ETF as it is a basket of stocks so a trader would need to buy an inverse ETF.

Liquidity

CFDs and ETFs tied to popular assets and markets are known for being highly liquid.

As a rule, traders have no trouble buying or selling a CFD or ETF at any time without causing slippage.

ETFs are available through stock exchanges, while CFDs are traded over the counter, with liquidity provision being assured by market makers.

Spreads

Both CFDs and ETFs incur a spread, which represents the difference between the bid price and the ask price. Spreads are dependant upon the liquidity of the product with more liquid instruments generally offering tighter spreads.

Trading Periods

Both ETFs and CFDs don’t have an expiry time like futures contracts, which makes them great instruments for short-term and long-term strategies.

CFD vs ETF Trading: Which Instrument Should You Choose to Trade?

To begin with, whether ETFs or CFDs suit your needs depends on the asset class you’re interested in and the trading style. For example, if you want to trade cryptocurrencies, there are no ETF choices besides Bitcoin and Ethereum. ETF opportunities are also minimal for traditional currencies. Therefore, crypto and forex traders would prefer trading FX CFDs or crypto CFDs.

In addition to market choice, CFDs are better suited for traders with short-term goals and higher risk tolerance, while ETFs are more suitable for investors seeking gradual, long-term growth.

CFD vs ETF Comparison Table

| CFDs | ETFs | |

| Type | Derivatives | Funds |

| Ownership | No ownership of the underlying asset | Indirect ownership of the underlying asset through a share in the fund |

| Underlying assets | Forex, stocks, indices, bonds, commodities, cryptocurrencies | Stocks, indices, bonds, commodities, cryptocurrencies (Bitcoin and Ethereum only) |

| Leverage | Ranging between 5:1 to 100:1 and higher | 2:1 and 3:1 on certain markets |

| Short selling | Easy to open short positions | Short selling is more complex |

| Dividends | Balance adjustment for dividends | ETFs exposed to stocks and bonds pay dividends |

| Fees | Spreads, commissions, overnight fees | Annual management fee, tight spread |

| Regulation | Less strict regulation but illegal in the US, Hong Kong and a few other jurisdictions. | Strict regulations |

| Trading hours | Available 24/7 for crypto assets, 24/5 for forex pairs and other assets | Traded during market hours on business days |

| Taxes | Vary by jurisdiction; can be more complex | Taxed like stocks |

| Trading style | Suitable for short-term, high-risk trading | Ideal for long-term, low-risk trading |

Trading Periods and Spreads: A Comparison

When it comes to trading periods, CFDs offer greater flexibility, enabling traders to open and close positions outside regular market hours. In contrast, ETFs are available only during market hours on business days, limiting the possibility of opening or closing positions on weekends or holidays.

The great thing about ETFs is that they typically have tighter spreads due to their high liquidity, while CFDs could have wider spreads, especially for less liquid assets.

This difference in trading hours and spreads makes CFDs more suited for active traders and ETFs for long-term investors.

FAQs

Do professional traders prefer CFDs or ETF?

Professional traders often prefer CFDs for short-term trading due to leverage and flexibility, while ETFs are favoured for long-term, passive investments.

Are CFDs ETF?

No, CFDs and ETFs are different financial instruments. CFDs are derivatives, while ETFs are funds comprising securities.

Are CFDs riskier than ETF trading?

Yes, CFDs are considered riskier due to leverage, which can amplify losses.

Is CFD better than investing?

It depends on your preferences and goals. CFDs are suitable for active, short-term trading, while ETFs are better for long-term holding periods.

Can I trade both CFDs and ETFs?

Yes, you can trade both CFDs and ETFs. For example, you can use CFDs to gain exposure to assets on a shorter-term strategy and invest in ETFs to target certain sectors. Additionally, you can use CFDs to hedge ETF positions, especially as short selling is much easier with CFDs.

Can I lose more money than I invest in CFDs?

Yes, with CFDs, you can lose more than your initial investment due to leverage, especially during high volatility.