Elliott wave

- March 17, 2025

- 2min read

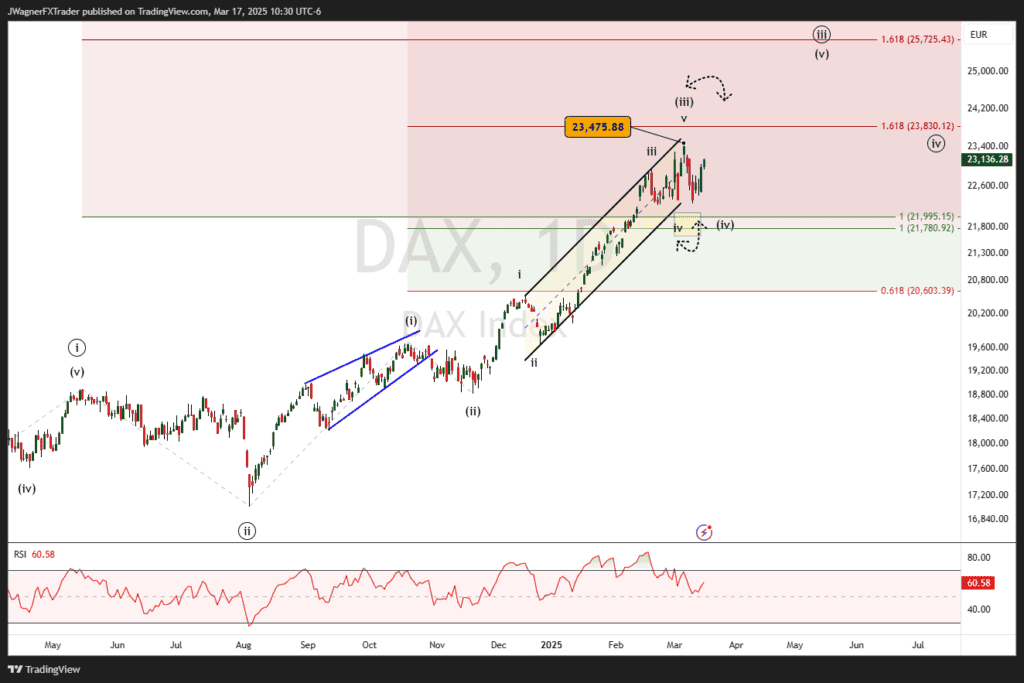

DAX Elliott Wave: Uptrend Still Intact, but a Correction Looms

Executive Summary

- Bullish bias continues, with the DAX in a third wave extension of a larger impulse.

- Key target near 23,830 (1.618 Fibonacci extension of previous wave).

- Potential pullback target: 21,995–21,780 zone if wave (iv) develops.

Current Elliott Wave Analysis

The DAX Index remains in a well-established uptrend as previously forecasted in early February, “Bulls on a Mission”. DAX is forming an Elliott wave five-wave impulse pattern. The primary trend suggests the index is currently in ((iii)) at a higher degree. We are considering that wave (iii) of ((iii)) may have topped at 23,475 on March 6. The wave (iii) has extended within a strong channel, indicating bullish momentum.

We are following an alternative count that varies slightly where at a lower degree wave iv, a corrective phase, just ended. That implies a final push higher in wave v of (iii). A target for wave v of (iii) shows wave relationships near 23,830 where wave (iii) is 1.618 Fibonacci extension of wave (i).

The Relative Strength Index at 60.52 suggests a trend moving to the upside and that aligns with a fifth wave at a smaller degree of trend.

The bullish forecast remains viable so long as prices don’t press below the wave i of (iii) high of 20,522.

Bottom Line

DAX’s impulse wave structure remains bullish, with the potential for a short-term correction before a final wave v push higher. Key support lies between 21,995 and 21,780, while upside targets appear near 23,830 and 25,725. Traders should watch for signs of exhaustion in the current rally and prepare for a pullback before the next leg higher.

You Might Be Interested In: