Elliott wave

- March 20, 2025

- 2min read

Gold’s Next Move: XAUUSD Elliott Wave Forecast

Executive Summary

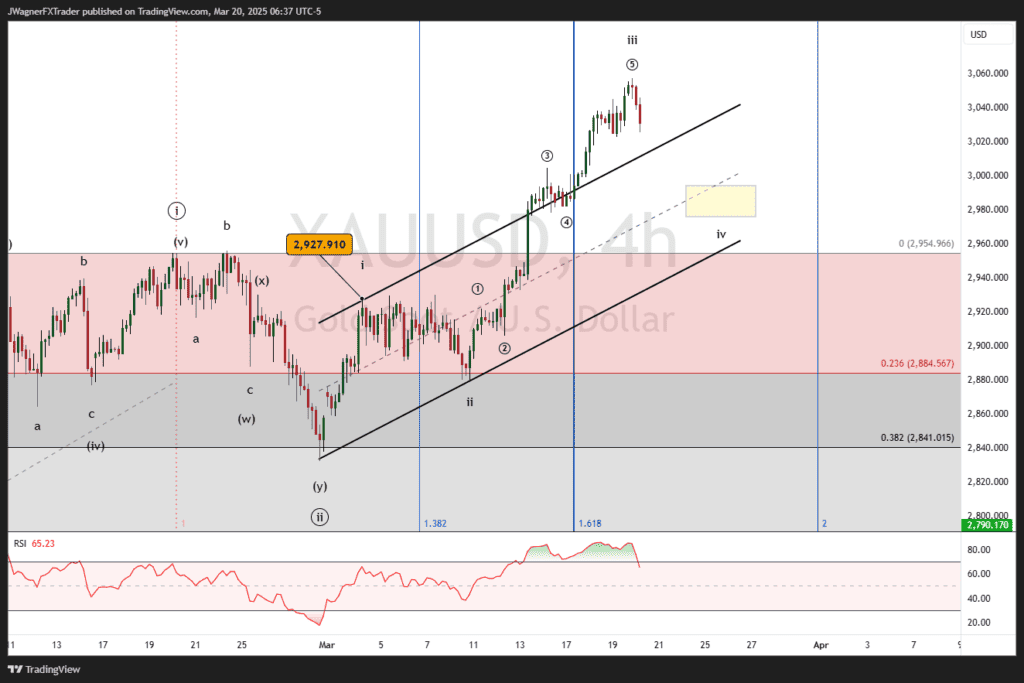

- Trend Bias: Gold (XAUUSD) is in the middle of a bullish wave iii of (i) of ((iii)).

- Key Levels: Support zones to watch include $2,978 and $3,000 (includes previous 4th wave).

- Once wave iv terminates to the downside, then we anticipate wave v to new highs.

Current Elliott Wave Analysis

Gold’s price action confirms that Wave ((ii)) bottomed on February 28 and wave ((iii)) has begun to the upside.

Our Elliott wave analysis suggests that waves i, ii, and iii are likely in place. If so, then a correction lower in wave iv would be considered normal within the larger impulse pattern.

We can use the Fibonacci retracement tool to anticipate where wave ‘iv’ may dip to. Typically, wave ‘iv’ corrects 38.2% the length of wave ‘iii’. Plus, wave ‘iv’ is likely to retrace back to support created by a previous fourth wave.

The correction lower should hold above $2,927, the wave ‘i’ high of the smaller degree impulse pattern.

Bottom Line

Gold’s rally pattern appears to be incomplete. A small degree wave iv correction may be underway that could carry Gold down to $2,978 – $3,000.

So long as gold holds above the wave ‘i’ high of $2,927, then we can anticipate continued new all-time highs with temporary dips along the way.

You might also be interested in: