Opening bell

- March 27, 2025

- 2min read

FX Market Shrugs Off Auto Tariffs as Dollar Stays Range-Bound

The foreign exchange market barely blinked following yesterday’s announcement of a hefty 25% tariff on US auto imports, leaving major currencies surprisingly steady overnight.

Who’s in the firing line?

Mexico, Canada, Germany, Japan, and South Korea – the main exporters targeted – saw little to no drop in their currencies, raising eyebrows among analysts. The muted response suggests tariff fatigue may be setting in, with markets perhaps expecting this move and pricing it in long ago.

Adding to the calm, President Trump hinted that next week’s reciprocal tariffs might be more lenient, possibly to cushion the still-sensitive US stock market.

Tariff Talk: What’s the Real Impact?

Reports estimate the tariffs could affect up to $500 billion worth of auto and auto parts. However, confusion remains about how US-sourced components within global supply chains will be treated. This is particularly worrying for Japan and South Korea, whose car exports include minimal US content, making them more exposed to the full brunt of the tariffs.

Despite the headline, the FX market appears to be shifting its focus from the initial announcement effect to the longer-term economic fallout – particularly how these tariffs will affect business confidence, consumer spending, and ultimately, the hard economic data in Q2.

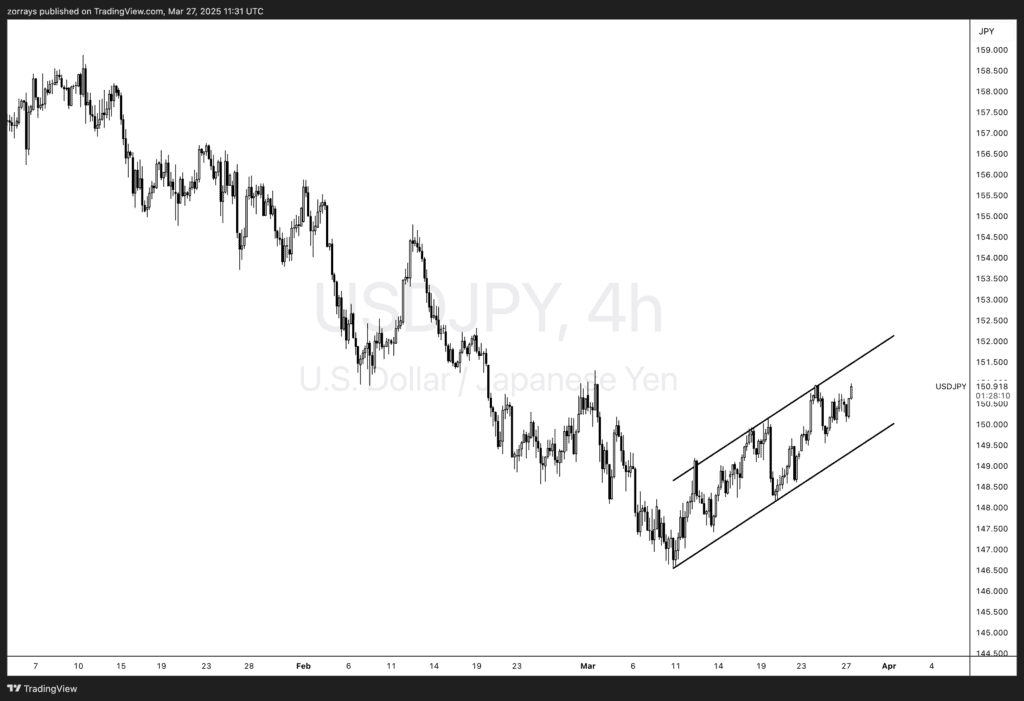

Dollar Direction: Still in a Tight Range

All this leaves the US dollar treading water, with the DXY index hovering between 104.00 and 104.50. Investors are watching closely for any downside risks, especially if US stocks wobble again and drag Treasury yields down with them.

In such a scenario, the Japanese yen could shine as a safe-haven currency, despite Japan’s vulnerability to the auto tariff issue.

What’s on the Radar Today?

Markets are eyeing a few key US data releases that could nudge the dollar:

- Q4 GDP revisions

- February’s trade deficit figures

- Weekly jobless claims

A surprise narrowing of the trade gap could be mildly positive for the dollar, hinting at a stronger-than-expected Q1 growth outlook. On the flip side, a jump in jobless claims might weigh on sentiment and hurt the greenback.

Bottom Line:

Markets are taking the latest tariff news in stride – for now. But with uncertainty hanging over global supply chains and upcoming US data releases, volatility could be just around the corner.