Weekly outlook

- March 28, 2025

- 4min read

ISM Data in Focus as SPX Breaks Down and DXY Weakens Further

As markets head into the first week of April 2025, investors are bracing for a wave of key economic data—most notably, the ISM Manufacturing PMI (Tuesday) and the ISM Services PMI (Thursday). These releases will offer a fresh pulse check on the U.S. economy amid a backdrop of softening growth expectations, increased policy uncertainty, and shifting Federal Reserve sentiment.

Market Breakdown: SPX and DXY Show Technical Weakness

Two critical market charts are flashing warning signs:

S&P 500 Index (SPX):

The daily chart shows that SPX has broken down from a bearish flag pattern following a rejection at the anchored VWAP (Volume-Weighted Average Price). This signals that the recent relief rally was more likely a dead cat bounce than the beginning of a sustainable recovery. As of March 28, SPX is trading around 5591, confirming a breakdown and suggesting further downside pressure unless data surprises to the upside.

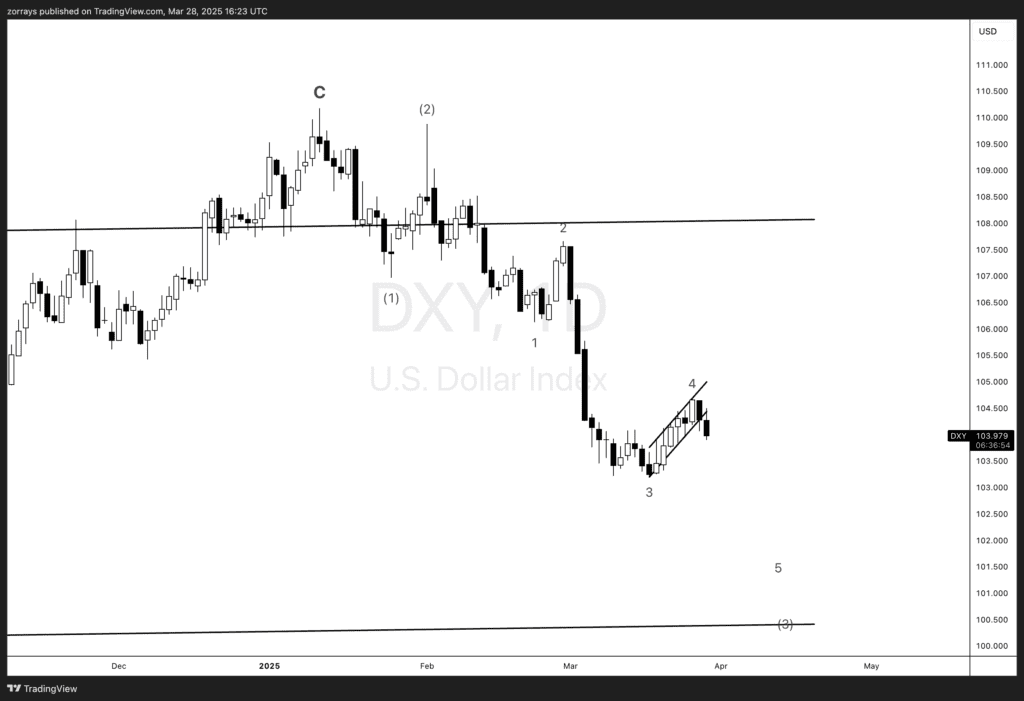

U.S. Dollar Index (DXY):

The DXY appears to be concluding Elliott Wave wave 4 of a broader impulsive move lower, with a likely wave 5 decline brewing. The recent bounce looks corrective in nature and is already showing signs of weakness. This aligns with the macro sentiment leaning increasingly dovish, as economic data underwhelms and inflation softens.

Why the ISM Data Next Week Matters

1. ISM Manufacturing PMI (Tuesday, April 1, 2025)

- Previous Reading (Feb 2025): 50.3

- New Orders: Contracted at 48.6, hinting at soft demand

- Expectations: A dip below 50 could officially mark renewed contraction in manufacturing and fuel concerns over Q2 growth.

This data is a direct input into GDP models, and a weak print could accelerate downward revisions to real GDP growth—which already has been slashed to 1.7% by Goldman Sachs for FY2025 (down from 2.2%).

2. ISM Services PMI (Thursday, April 3, 2025)

- Previous Reading: 53.5 (unexpected beat)

- Outlook: The services sector remains resilient, but any surprise dip below 50 would be a red flag. Given its heavy weighting in U.S. GDP, this reading is crucial.

The Macro Picture: Uncertainty + Dovish Fed Tilt?

Recent economic and market developments suggest a potential policy pivot:

- GDP Forecasts Slashed: S&P Global sees GDP growth slowing to 1.9% in 2025, consistent with Goldman Sachs’ 1.7% estimate.

- Tariffs Return: The average U.S. tariff rate is now expected to rise by 10 percentage points, potentially shaving 1–2% off S&P 500 EPS.

- Earnings Revised Lower: SPX EPS estimates were cut to $262 from $268, with EPS growth expected at 7%, not 9%.

- Recession Probability: Economists place recession odds at 20–25% over the next year.

With equity markets under pressure and macro risks piling up, the Federal Reserve is now facing renewed pressure to remain dovish or potentially even pivot to rate cuts if data turns south.

Implications for the S&P 500 and the Dollar

| Asset | Current Setup | Near-Term Outlook |

|---|---|---|

| S&P 500 (SPX) | Bearish flag breakdown below anchored VWAP | Further downside likely if ISM disappoints; could test 5500-5400 zone |

| U.S. Dollar Index (DXY) | End of corrective wave 4, downside resumption expected | More weakness ahead, particularly if Fed pivots dovish on weak ISM + GDP data |

Looking Ahead: What Could Turn This Around?

Goldman Sachs notes three scenarios that could reignite the bull case:

- Improved Economic Data – If ISM beats expectations, sentiment could reverse quickly.

- Valuation Reset – A significant correction could open up attractive entry points for long-term investors.

- Capitulation in Positioning – Hedge fund de-risking may create a contrarian buying opportunity, especially in “AI-insensitive” and discounted names.

Final Takeaway

Next week’s ISM reports will be pivotal not just for understanding the state of the U.S. economy, but also for determining the direction of the S&P 500 and the U.S. Dollar. With SPX technically breaking down and DXY setting up for further declines, all eyes will be on whether data softens enough to shift the Fed decisively dovish—or if a surprise upside beat offers a temporary reprieve.